Virginia’s Renter Population

April 13, 2020

In 2018, there were an estimated 2.7 million renters in Virginia, and increase over more than 260,000 over the number in 2010. While homeownership rates have been on the rise for many groups over the past few years, the renter population remains an important segment of the housing market in the Commonwealth.

What do we know about the characteristics of Virginia’s renters?

Not surprisingly, the highest shares of renters across the Commonwealth are in the most urban places. There are six communities in Virginia where more than half of the households are renter households. The top ten renter locations are all located in Northern Virginia, Hampton Roads, or in the City of Richmond.

Top 10 Neighborhoods for Renters

| Neighborhood | Total households | Renter households | Renters as a share of all households |

| South Arlington | 53,515 | 34351 | 64.2% |

| Alexandria | 69,979 | 40540 | 57.9% |

| Richmond (City) | 89,846 | 51767 | 57.6% |

| Northeast Norfolk | 80,582 | 45580 | 56.6% |

| Newport News | 69,235 | 35753 | 51.6% |

| Portsmouth/Southwest Norfolk | 44,043 | 22169 | 50.3% |

| North Arlington | 51,182 | 24777 | 48.4% |

| Roanoke/Salem | 55,458 | 25572 | 46.1% |

| East Central Fairfax (County) | 51,021 | 22828 | 44.7% |

| Hampton | 53,671 | 23826 | 44.4% |

Source: 2018 American Community Survey Public Use Microdata Sample (PUMS) 5-year file

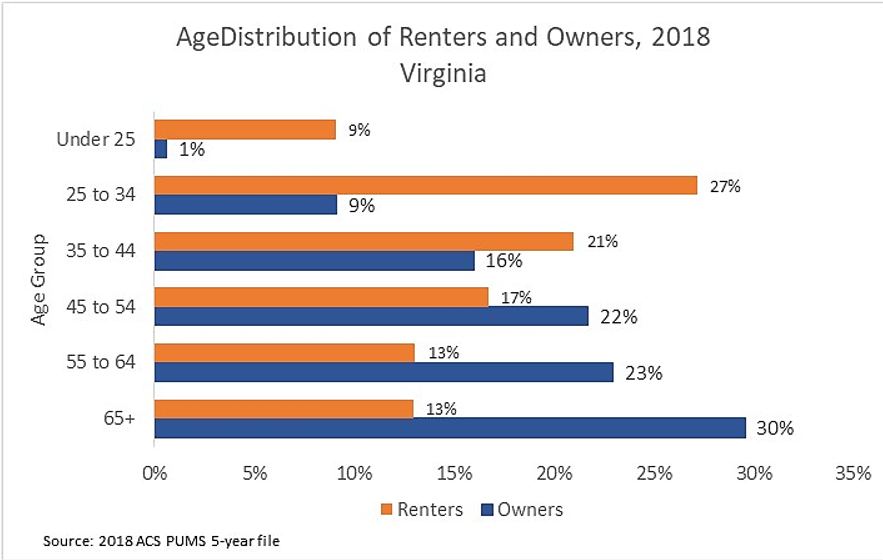

While renters tend to be younger than homeowners, people of all ages—from young adults in their early 20s to seniors in their 60s and 70s—are part of Virginia’s renter population. While less than 1% of owners are under the age of 25 are homeowners, people under 25 make up 9% of all renter households. The biggest gap is among older adult households. About 30% of owners in Virginia are age 65 and older; by comparison, only 13% of renters are age 65 and older.

Because seniors make up such a larger share of owner-occupied housing, renters are actually slightly more likely than owners to have children living at home. About a third (33%) of renter households have children under 18, compared with 31% of homeowners.

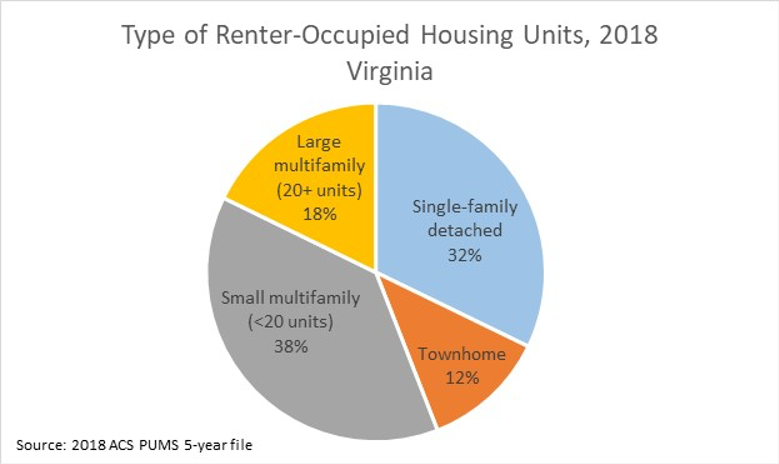

While the largest share of renters lives in apartments in small multifamily buildings (i.e. buildings with fewer than 20 units), there is also a large share of people who rent single-family houses throughout Virginia. The stock of single-family rentals increased dramatically after the recession and housing market downturn in 2007 through 2009. While single-family homes have converted to owner-occupied in some markets, single-family housing remains an important part of the rental stock in many places.

Townhomes or single-family attached homes have also served an important part of the rental market. Townhomes account for about 12% of both renter-occupied and owner-occupied housing in Virginia. A relatively small share of renters—less than one in five—lives in a large multifamily apartment building.

Outlook for Renters

During this unprecedented public health crisis, renters and property managers throughout the country are facing challenges. While assistance has been made available to some single-family and multifamily property owners negatively impacted by COVID-19, to date there has been no systematic response to aid landlords and property managers. At the same time, renters are more likely than owners to face unemployment and wage cuts. The biggest job losses over the past several weeks have been in the restaurant, retail, and administrative services sectors, which tend to have higher shares of renters than other sectors.

Between April 1 and 5, 2020, nearly a third of renters had failed to pay their rent, up from 19% of renters in March. According to a recent National Association of REALTORS® survey, 67% of property managers and 44% of individual landlords say they have tenants who are unable to pay their rent.

Virginia REALTORS® continues to track impacts of COVID-19 on for-sale and rental markets throughout Virginia. Be sure to check back often for more data and analysis.

You might also like…

2024 Rental Market Outlook

By Dominique Fair - January 17, 2024

The multifamily market has had many highs and lows over the past few years with rising rental prices and a shift in demand, which led to record-breaking construction… Read More

Pulse Check on Rent in Virginia’s Metro Markets

By Dominique Fair - October 23, 2023

Virginia’s housing market has seen many highs over the last year with interest rates above 7% and housing prices above $400,000. These factors have pushed many potential home… Read More

Are You Dealing With Unclaimed Funds?

By Santiago Montalvo - July 18, 2023

What can you do if you have money left over from the Security Deposit disposition? The tenant didn’t leave a forwarding address and they aren’t contacting you anymore.… Read More