April Home Sales Illustrates a Seller’s Market

May 25, 2017

Residential real estate sales illustrate that market conditions are increasing favorable for sellers. Limited supply enables sellers to list at a premium and buyers wary of rate increases are moving with historical speed to absorb inventory as it emerges.

Year-over-year, pace declined as a result of inventory constraints. A factor limiting supply is that owners who would sell are not confident in the availability of housing for their next purchase. Year-over-year, the number of transactions in April slid by 3.6 percent (10,209 in 2016 and 9,844 in 2017). Also reflecting inventory limitations, April sales were slightly lower than March’s (down 0.1 percent from 9,858). Typically, pace rises each month from January through the summer peak.

April 2017 volume (the sum of all transactions) was $3.262 billion, falling 1.9 percent from last year’s April volume. On the month, volume rose 2.6 percent (from $3.179 billion). The decline in volume is another indicator of the inventory shortage. Despite rising prices, pace was too suppressed to drive volume higher than last year’s benchmark.

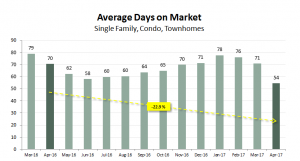

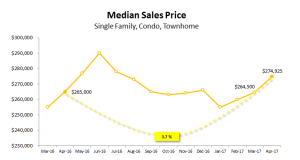

Statewide median sales price for April 2017 was $274,925, an increase of 3.7 percent from the median price last April ($265,000). On trend with industry seasonality, April median price rose from March’s $264,500 (3.9 percent). Rising median price and accompanying decline in average days on the market point to demand increasingly exceeding supply. The average number of days on the market declined significantly year-over-year by nearly 23 percent, from 70 to only 54 days.

You might also like…

Climbing Prices and Mortgage Rates Dampen Virginia’s Spring Housing Market

By Robin Spensieri - April 25, 2024

According to the March 2024 Virginia Home Sales Report released by Virginia REALTORS®, sales activity in Virginia’s housing market slowed down last month. Statewide, there were 8,075 homes sold… Read More

5 Key Takeaways from the NAHREP 2023 State of Hispanic Homeownership Report

By Sejal Naik - April 17, 2024

In March 2024, the National Association of Hispanic Real Estate Professionals (NAHREP) released its 2023 State of Hispanic Homeownership Report. Using data from surveys conducted by various public… Read More

3 Multifamily Market Trends from the First Quarter

By Dominique Fair - April 16, 2024

For the last three years, the multifamily market has seen high demand, double digit rent growth, and increased construction to meet demand. These trends are expected to shift… Read More